sales tax rate in tulsa ok

This includes the rates on the state county city and special levels. Tulsa County Sales Tax.

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The average cumulative sales tax rate between all of them is 828.

. Average Sales Tax With Local. A county-wide sales tax rate of 0367 is applicable. The Tulsa County sales tax rate is 037.

The most populous location in Tulsa County Oklahoma is Tulsa. 6 rows The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The average cumulative sales tax rate in Tulsa Oklahoma is 831.

Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. Rates and Codes for Sales Use and Lodging Tax 1912 Bristow 4 to 5 Sales and Use Increase July 1 2021 5805 Commerce 4 to 3 Sales and Use Decrease July 1 2021. The December 2020 total local.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367. You can find more tax rates and.

Sales Tax in Tulsa Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The current total local sales tax rate in Tulsa County OK is 4867. 892 Is this data incorrect.

Tulsa has parts of it located within Creek. The Tulsa County Sales Tax is 0367. With local taxes the total sales tax rate is between 4500 and 11500.

State of Oklahoma 45. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402.

The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales. The 2018 United States Supreme Court decision in South Dakota v. As far as all cities towns and locations go the place with.

Some cities and local governments in Tulsa County. 4 rows The current total local sales tax rate in Tulsa OK is 8517. The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel.

What is the lodging tax rate. Oklahoma has recent rate changes Thu Jul 01 2021. The December 2020.

The City of Tulsa imposes a lodging tax of 5 percent. The state sales tax rate in Oklahoma is 4500. Has impacted many state nexus laws and sales tax collection.

There are a total of 470. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. You can find more tax.

Oklahoma State Sales Tax.

Taxes Broken Arrow Ok Economic Development

Downtown Tulsa Oklahoma Postcard 1960 S Ebay

Oklahoma House Passes Grocery Tax Elimination Personal Income Tax Reduction Oklahoma Thecentersquare Com

Oklahoma One Percent Sales Tax State Question 779 2016 Ballotpedia

Sales Tax Datalink Salestaxdlink Twitter

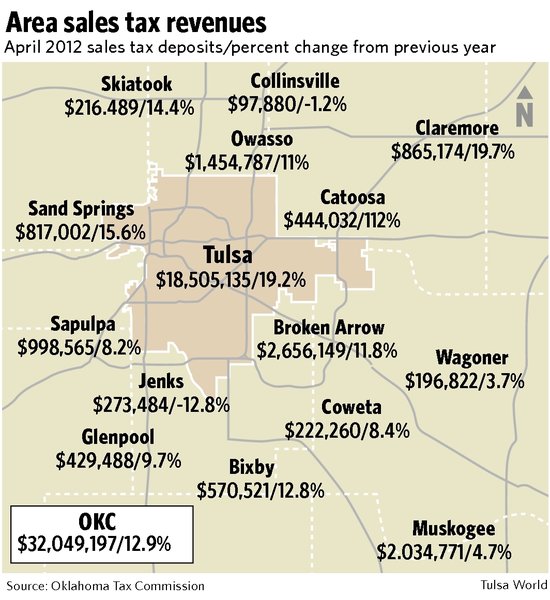

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Tulsa Oklahoma Ok University Of Tulsa 1940s Ebay

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tax Forms Tax Information Tulsa Library

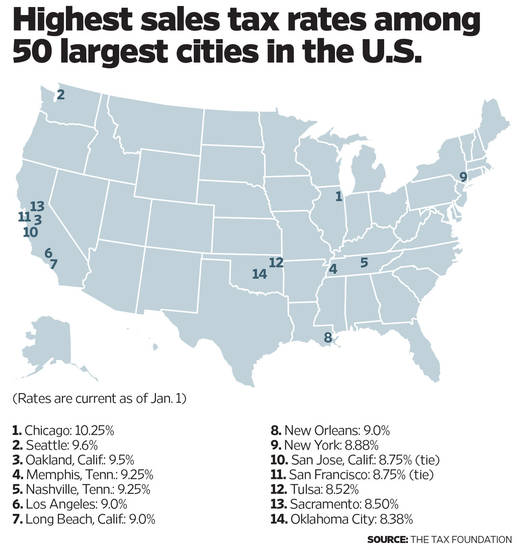

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Pull Factors A Measure Of Retail Sales Success Estimates For 77 Oklahoma Cities 2018 Oklahoma State University

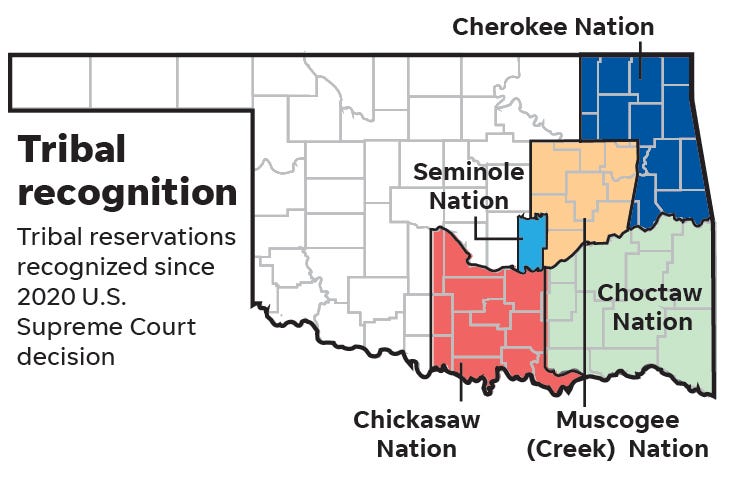

Supreme Court S Mcgirt Decision Results In Tax Protests In Oklahoma

Tulsa County Ok Businesses For Sale Bizbuysell

Charles Drury On Twitter Kevin Herzberg Grantthorntonus Breen Schiller Hmbchtd Amp Cost S Karl Frieden David Sawyer Cover Key State Tax Cases Issues Amp Policy Matters Including Sales Taxation After Wayfair Modernizing State Sales Taxes

1924 E Oklahoma Pl Tulsa Ok 74110 Realtor Com

Tax Forms Tax Information Tulsa Library

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

The Tax Take From Medical Marijuana By County Oklahoma Watch

/https://s3.amazonaws.com/lmbucket0/media/business/3SJU_Tulsa_OK_20220921212929_Ext_01.8361d0fe01f01c1987e590fbad4e71a232365914.jpg)